Perplexed about whether or not you need a license to sell on Amazon? As an experienced Amazon seller, I can confidently tell you that understanding the legal requirements is crucial for your success on the platform. While Amazon does not require a specific license to sell on their platform, there are still certain legal obligations and regulations that you need to be aware of. In this comprehensive guide, I will walk you through the important legal considerations to keep in mind as an Amazon seller, from business licenses to sales tax requirements. By the end of this post, you will have a clear understanding of the legal framework for selling on Amazon and feel confident navigating the requirements. Let’s dive in and ensure that you are legally compliant while making the most of your Amazon selling journey.

Key Takeaways:

- Know the legal requirements: Make sure to research and understand the legal requirements for selling on Amazon in your specific location.

- Licensing may be necessary: Depending on the type of products you intend to sell, you may need to obtain certain licenses or permits.

- Compliance is crucial: Adhering to legal requirements is essential to avoid potential fines or penalties, as well as to build trust with customers.

- Be aware of international regulations: If you plan to sell internationally, be sure to understand and comply with the legal requirements of each country you intend to do business in.

- Consult with legal experts: If you have any uncertainties about the legal requirements for selling on Amazon, it’s advisable to seek guidance from legal professionals who specialize in e-commerce.

Understanding Legal Requirements for Amazon Sellers

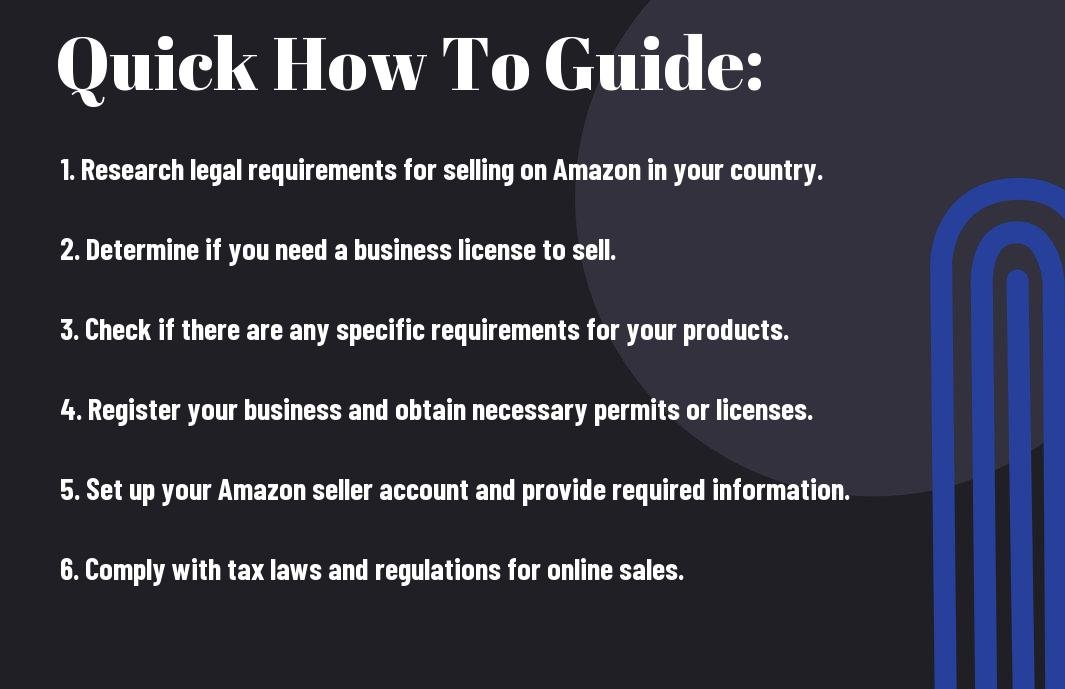

Before I delve into the specifics of the legal requirements for Amazon sellers, it is important to understand that selling on Amazon is a business, and as such, it is subject to certain legal requirements. As an Amazon seller, you are responsible for ensuring that you comply with all applicable laws and regulations, including obtaining any necessary licenses and permits.

How to Determine if You Need a License to Sell on Amazon

As an Amazon seller, it is crucial to determine whether you need a license to sell your products. This will largely depend on the type of products you are selling and the location from which you are operating. Generally, if you are selling regulated products such as alcohol, firearms, organic foods, or pharmaceuticals, you will need specific licenses or permits. To find out what licenses you may need, you can contact your state’s business licensing office or consult with a legal professional.

Tips for Obtaining the Necessary Licenses and Permits

When it comes to obtaining the necessary licenses and permits, research is key. Start by identifying the specific regulations that apply to your product or business. Once you have a clear understanding of the requirements, contact the relevant government agencies to apply for the necessary licenses or permits. It is important to be proactive in this process, as failing to obtain the required licenses or permits can result in penalties or even the suspension of your Amazon seller account. Though the process may seem daunting, obtaining the necessary licenses and permits is a crucial step in ensuring the legality and longevity of your Amazon business.

Factors to Consider When Selling on Amazon

Any individual or business considering selling on Amazon should take certain factors into consideration. These include product regulations, tax implications, intellectual property protection, and product liability. Ignoring any of these factors can have serious legal consequences, so it is imperative to carefully assess and address each one before launching your business on Amazon.

Navigating Tax and Regulatory Compliance

While it’s exciting to start selling on Amazon, it’s important to ensure that you are meeting all necessary tax and regulatory requirements. Failing to do so can lead to fines, penalties, or even suspension of your seller account. This chapter will guide you through the essential steps to ensure compliance with tax and regulatory laws as an Amazon seller.

How to Handle Sales Tax as an Amazon Seller

As an Amazon seller, understanding and managing sales tax is crucial. I recommend researching the sales tax laws in the states where you have nexus – such as where you have a physical presence, employees, or inventory storage. You may need to register for a sales tax permit in those states and collect sales tax from buyers. Utilizing tax automation software can streamline this process and ensure you are accurately collecting and remitting sales tax.

Tips for Ensuring Regulatory Compliance

When selling on Amazon, ensuring compliance with regulatory requirements is vital to your success. Here are some tips to help you stay on the right side of the law:

- Regularly review Amazon’s seller policies and guidelines to stay updated on legal requirements.

- Obtain any necessary permits and licenses for the products you are selling.

- Ensure that you are in compliance with consumer safety regulations and product labeling requirements.

Any failure to comply with regulations can result in serious consequences for your Amazon business, so it’s crucial to stay informed and proactive in your compliance efforts.

Factors to Keep in Mind for International Selling

Selling internationally on Amazon can present additional tax and regulatory considerations. You must be aware of import/export laws, customs duties, and any other regulations specific to the countries where you are selling your products. Additionally, I recommend consulting with a tax professional to ensure you understand and comply with the tax implications of international sales. Any oversight in this area can lead to costly penalties and delays in your international operations.

Protecting Your Business

Not only is it important to understand the legal requirements for selling on Amazon, but it is also crucial to protect your business to ensure its success. There are several key factors to consider when it comes to protecting your business as an Amazon seller.

How to Protect Your Intellectual Property Rights on Amazon

When selling on Amazon, it’s essential to protect your intellectual property rights, such as trademarks, patents, and copyrights. One way to do this is by enrolling in Amazon’s Brand Registry program, which provides additional protection for your brand and products. Additionally, you may consider seeking legal counsel to ensure that your intellectual property rights are adequately protected.

Tips for Managing Product Liability Issues

As an Amazon seller, it’s crucial to manage product liability issues to protect your business from potential legal disputes. This may include carrying adequate product liability insurance and implementing stringent quality control measures to minimize the risk of product defects. It’s also important to stay informed of any product safety regulations that may apply to your products and to address any customer complaints or issues promptly.

- Carry adequate product liability insurance

- Implement stringent quality control measures

- Stay informed of product safety regulations

- Address customer complaints promptly

Though product liability issues can be complex, taking these proactive measures can help protect your business from legal and financial consequences.

Factors to Consider for Legal Disputes with Amazon or Other Sellers

Knowing the factors to consider for potential legal disputes with Amazon or other sellers is imperative for protecting your business. This includes understanding contractual obligations, compliance with Amazon’s policies, and risk management strategies. Additionally, it’s essential to be aware of dispute resolution processes and to keep thorough records of all communications and transactions.

- Understanding contractual obligations

- Compliance with Amazon’s policies

- Risk management strategies

- Dispute resolution processes

Knowing these key factors can help you navigate legal disputes effectively and protect your business from potential legal challenges.

The Importance of Understanding Legal Requirements for Amazon Sellers

The legal requirements for selling on Amazon are essential for anyone looking to establish a successful business on the platform. Understanding the need for a license and other legal obligations is crucial in order to avoid potential pitfalls and legal issues down the road. As someone considering selling on Amazon, it is important to familiarize yourself with the licensing requirements and ensure that you are in compliance with all relevant laws and regulations. By doing so, you can set yourself up for success and avoid any legal implications that may arise from not adhering to the necessary legal requirements.

FAQ – Understanding Legal Requirements for Amazon Sellers

Q: Do I need a license to sell on Amazon?

A: Yes, you will need a business license to sell on Amazon. This can be a local business license or a state sales tax permit, depending on your location and the nature of your business.

Q: What kind of business license do I need to sell on Amazon?

A: The type of business license you need will vary depending on your location and the nature of your business. You may need a general business license, a seller’s permit, or a state tax registration. It’s important to research and understand the specific requirements for your situation.

Q: Are there any other legal requirements for selling on Amazon?

A: In addition to a business license, you may need to register for sales tax collection in states where you have a physical presence. You also need to comply with Amazon’s seller policies and guidelines, including providing accurate product descriptions, maintaining inventory levels, and fulfilling orders in a timely manner.

Q: What happens if I don’t have the necessary licenses or permits?

A: Operating a business without the required licenses or permits can result in fines, penalties, or legal action. Amazon may also suspend or terminate your seller account for non-compliance with legal requirements.

Q: How can I ensure that I am meeting all legal requirements as an Amazon seller?

A: It’s crucial to research and understand the specific legal requirements for selling on Amazon in your location. Consult with legal and tax professionals to ensure that you have the necessary licenses and permits, and that you are complying with all laws and regulations. Regularly review Amazon’s policies and guidelines to stay updated on any changes or new requirements.