Ubiquitous across all industries, payroll is a crucial aspect of any business, including Amazon. As someone who has worked for Amazon, I understand the importance of knowing exactly when you will receive your hard-earned money. In this blog post, I will guide you through the payroll schedules and practices at Amazon, providing you with all the necessary information to ensure that you are well-informed about your pay and compensation.

Key Takeaways:

- Amazon employees are typically paid bi-weekly – Most employees at Amazon receive their pay every two weeks, with payday occurring on a set schedule.

- Direct deposit is the most common method of payment – Amazon employees often have their paychecks deposited directly into their bank accounts, making it quick and convenient.

- Payroll schedules can vary by location and position – Depending on the specific Amazon warehouse or corporate office, payroll schedules may differ, and certain positions may have different pay dates.

- Overtime pay is included in regular paychecks – Amazon employees who work more than 40 hours in a week will receive overtime pay, which is included in their regular bi-weekly paycheck.

- It’s vital for employees to understand their pay schedule and methods – To avoid confusion and ensure timely payment, Amazon employees should familiarize themselves with their specific payroll schedule and payment methods.

Understanding Amazon Payroll Schedules and Practices

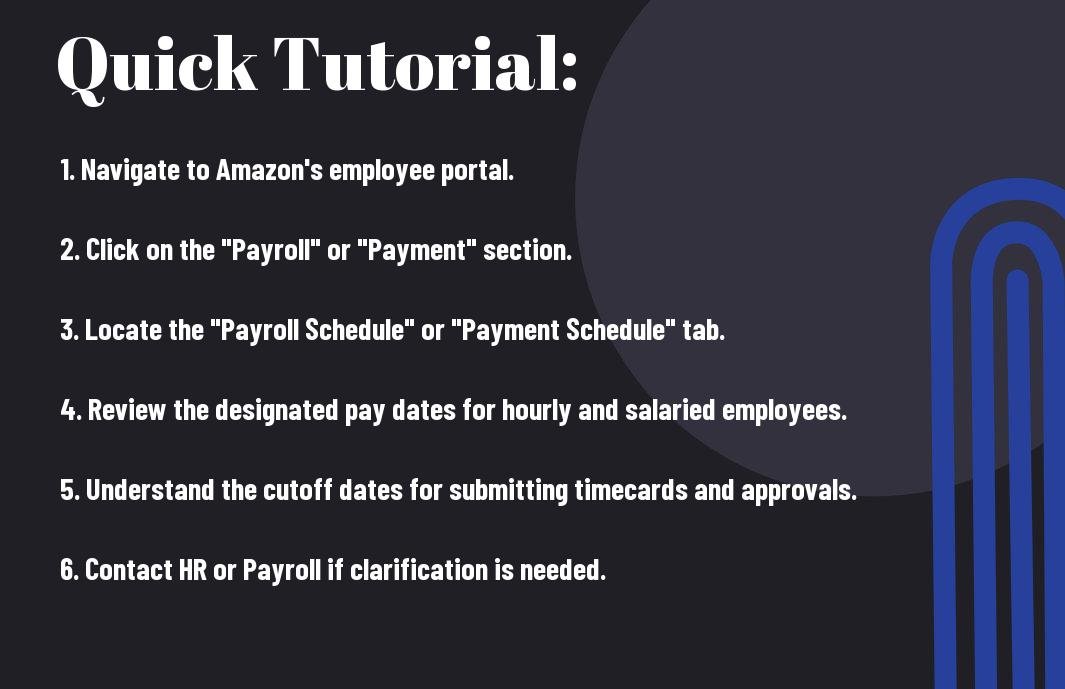

To ensure that you understand when and how Amazon employees get paid, it’s essential to have a good grasp of the company’s payroll schedules and practices.

Payroll Schedule Overview

Amazon has a biweekly pay schedule, which means employees are typically paid every two weeks. This schedule can vary slightly depending on the position and location, so it’s crucial to check with your HR department for specific details. With this schedule, you can expect to receive your paycheck on the same day every two weeks, offering consistency and predictability for your finances.

Direct Deposit and Paper Check Options

Amazon offers both direct deposit and paper check options for receiving your pay. Direct deposit is the most convenient and secure method, as the funds are deposited directly into your bank account on payday. However, if you prefer a paper check, Amazon can accommodate that as well. Just keep in mind that paper checks may take longer to process, and you’ll need to physically deposit or cash the check before accessing your funds.

Overtime and Holiday Pay

When it comes to overtime and holiday pay, Amazon compensates employees according to local labor laws and company policies. Overtime pay is typically offered for hours worked beyond the standard 40-hour workweek, while holiday pay may include additional compensation or premium rates for working on designated holidays. It’s important to familiarize yourself with Amazon’s specific policies regarding overtime and holiday pay to ensure you are fairly compensated for your time.

Bonus and Commission Structures

Amazon may offer bonus and commission structures for certain positions, providing employees with the opportunity to earn additional income based on performance, sales, or other predetermined criteria. These structures can vary widely depending on the role and department, so it’s crucial to understand the specific terms and conditions associated with any potential bonuses or commissions.

Payroll Deductions and Benefits

Amazon’s payroll also includes deductions for taxes, insurance premiums, retirement contributions, and other benefits. These deductions are crucial for maintaining your financial well-being and ensuring compliance with legal and company requirements. Understanding the various deductions and benefits offered by Amazon can help you make informed decisions about your overall compensation package.

Amazon Employee Payroll Process

For Amazon employees, the payroll process is an essential aspect of their employment. It determines when and how they will receive their hard-earned wages. Understanding the payroll process is crucial for employees to have clarity and confidence in their financial affairs. In this section, I will delve into the Amazon employee payroll process, covering timekeeping and attendance, payroll administration, and tax withholding and reporting.

Timekeeping and Attendance

When working for Amazon, it is important to adhere to timekeeping and attendance policies. Employees are required to accurately record their hours worked and adhere to their scheduled shifts. Your punctuality and attendance directly impact your payroll, as any discrepancies may result in delays or issues with your pay. Amazon utilizes various timekeeping systems to track employee hours, ensuring precise and fair compensation for your hard work.

Payroll Administration

The payroll administration at Amazon is a well-organized and efficient process. It involves the calculation of employee wages, withholding of taxes and other deductions, and the distribution of pay to employees. Amazon has a robust payroll system in place to ensure that employees are paid accurately and on time. This system also handles any additional payments, such as bonuses or overtime, with precision and transparency.

Tax Withholding and Reporting

Amazon is responsible for withholding the correct amount of taxes from employees’ paychecks and reporting this information to the relevant tax authorities. This ensures that employees fulfill their tax obligations without encountering any issues. It is crucial for employees to accurately complete their tax withholding forms to avoid any discrepancies or penalties. Understanding the tax withholding and reporting process is essential for employees to manage their finances effectively and remain compliant with tax laws.

Amazon Payroll FAQs

Now let me address some common questions people have about Amazon’s payroll practices.

How often do Amazon employees get paid?

Amazon employees are typically paid on a bi-weekly schedule. This means you can expect to receive your pay every other Friday. However, the exact frequency of payment may vary depending on your location and the specific Amazon subsidiary you work for.

What are the different payroll schedules at Amazon?

Amazon offers different payroll schedules to accommodate the varying needs of its employees. While most employees are paid on a bi-weekly basis, there are certain positions, such as temporary or seasonal roles, that may follow a different payment schedule. It’s important to familiarize yourself with the specific payroll schedule that applies to your role.

How does Amazon handle payroll discrepancies?

In the rare event that a payroll discrepancy occurs, Amazon has processes in place to address and rectify the issue promptly. If you notice any discrepancies in your pay, it’s crucial to report them to the appropriate personnel within the company so that they can be promptly addressed and resolved. Ensuring the accuracy of your pay is essential to your financial well-being, so do not hesitate to bring any concerns to the attention of the HR or payroll department.

Are there any special considerations for seasonal or temporary employees?

Seasonal and temporary employees at Amazon may have different considerations when it comes to payroll. While the general payment schedule is bi-weekly, there may be variations depending on the specific terms of your employment. It’s important to clarify the payroll schedule and any other relevant details with your supervisor or HR representative when you are hired.

Can employees access their paystubs and tax forms online?

Yes, Amazon provides employees with convenient access to their paystubs and tax forms through an online portal. This allows you to easily view and download your paystubs and tax documents whenever you need them. It’s important to keep track of these documents for your records, especially when tax season comes around.

When Do Amazon Employees Get Paid – Understanding Payroll Schedules and Practices

With this in mind, it is important for Amazon employees to understand their payroll schedules and practices in order to properly manage their finances and plan for upcoming expenses. By knowing when you can expect your paycheck, you can make informed decisions about budgeting and bill payments. Additionally, understanding the various payment methods and options available can help you choose the most convenient and efficient way to receive your earnings. Overall, being knowledgeable about Amazon’s payroll processes can help you stay on top of your financial responsibilities and make the most of your hard-earned income.